The stock market is a great place to grow your wealth, but it’s important to remember that it’s also a risky place. If you’re not careful, you could lose all of your investment. That’s why it’s important to have a solid risk management plan in place.

Here are a few tips for managing your risk in the stock market in 2023:

- Set stop-loss orders. A stop-loss order is an order to sell a stock when it falls to a certain price. This can help you limit your losses if the stock takes a downturn.

- Don’t put all your eggs in one basket. Diversify your portfolio by investing in a variety of different stocks. This will help to reduce your risk if one stock underperforms.

- Use technical analysis. Technical analysis is the study of past price and volume data to identify trends and patterns. This can help you to identify potential trading opportunities and manage your risk.

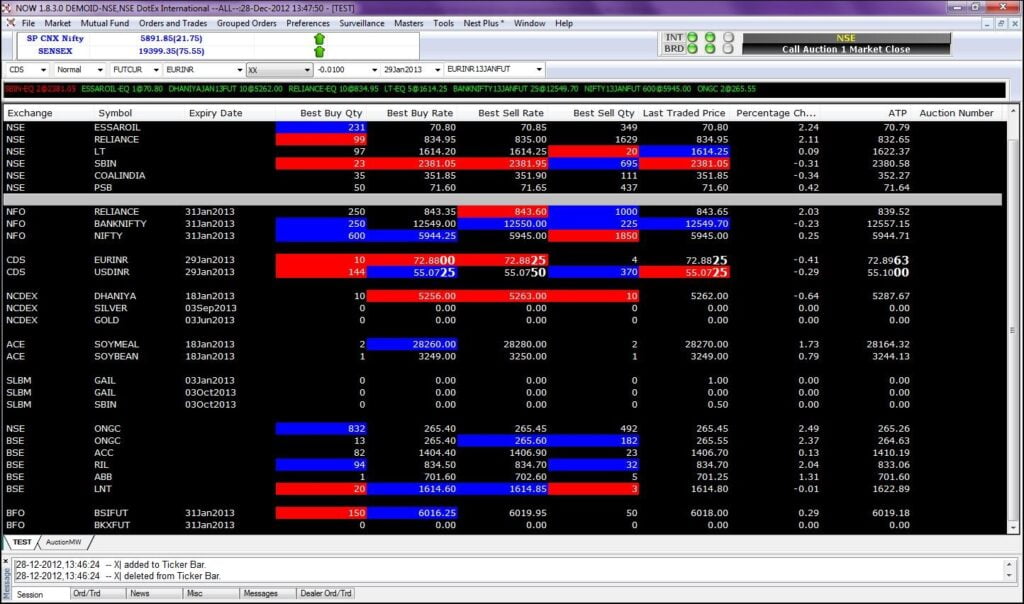

- Use risk management software. There are a number of different risk management software programs available that can help you to track your risk and make informed trading decisions.

Why Mudra Trade is the Best Trading Analysis and Signal Software

Mudra Trade is a powerful trading analysis and signal software that can help you to identify profitable trading opportunities and manage your risk. It offers a wide range of features, including:

- Real-time market data. Mudra Trade provides real-time market data for over 10,000 stocks and ETFs. This allows you to track the markets and identify trading opportunities as they happen.

- Technical indicators. Mudra Trade offers a wide range of technical indicators that can help you to identify trends and patterns in the market. This information can be used to make informed trading decisions.

- Backtesting and optimization. Mudra Trade allows you to backtest and optimize your trading strategies. This allows you to identify the best possible strategies for your trading style and risk tolerance.

- Trading signals. Mudra Trade provides trading signals for a variety of different stocks and ETFs. These signals can be used to identify potential trading opportunities and reduce your risk.

How to Use Mudra Trade for Risk Management

Mudra Trade can be used to manage your risk in a number of different ways. For example, you can use the software to identify stocks that are overvalued and should be avoided. You can also use the software to identify stocks that are showing signs of weakness and should be sold.

Additionally, you can use Mudra Trade to set stop-loss orders and manage your risk on individual trades. This can help you to limit your losses if a trade goes against you.

Overall, Mudra Trade is a powerful trading analysis and signal software that can help you to identify profitable trading opportunities and manage your risk. It is a great tool for traders of all levels of experience.

Here are a few specific examples of how you can use Mudra Trade for risk management:

- Identify overvalued stocks. Mudra Trade offers a number of different technical indicators that can be used to identify overvalued stocks. For example, you can use the Relative Strength Index (RSI) to identify stocks that are overbought and may be due for a pullback.

- Identify stocks showing signs of weakness. Mudra Trade can also be used to identify stocks that are showing signs of weakness. For example, you can use the Moving Average Convergence Divergence (MACD) to identify stocks that are losing momentum and may be headed lower.

- Set stop-loss orders. Mudra Trade allows you to set stop-loss orders for individual trades. This can help you to limit your losses if a trade goes against you.

- Manage your risk on individual trades. Mudra Trade provides a number of different tools that can help you to manage your risk on individual trades. For example, you can use the position size calculator to determine the optimal position size for a trade.

By using Mudra Trade for risk management, you can help to protect your capital and improve your chances of success in the stock market.